Decarbonisation has been a buzz-word over the past few years, and 2022 will rightfully be no different. In the EU, interlinking regulations such as the Sustainable Finance Disclosure Regulation (SFDR), Corporate Sustainability Reporting Directive (CSRD), and the EU Taxonomy aim to put all of organizational ESG impact reporting on par with financial reporting, thereby directing capital towards more environmentally and socially sustainable activities, including decarbonisation. In the UK, the Net Zero Strategy and anticipated UK Taxonomy will similarly drive a capital towards activities that decarbonise the economy and decouple resource consumption from growth.

This regulatory framework is critical to unlocking action because, although a leader among global regions, 40% of European companies at large still have yet to set an emissions reduction target, let alone comprehensively address the myriad other ESG issues that will now be required reporting for about 49,000 across the EU. The real estate industry in particular has a critical role to play, both in retrofitting existing assets and developing new net-zero assets, but also in creating value across the ESG spectrum for stakeholders from investors to communities.

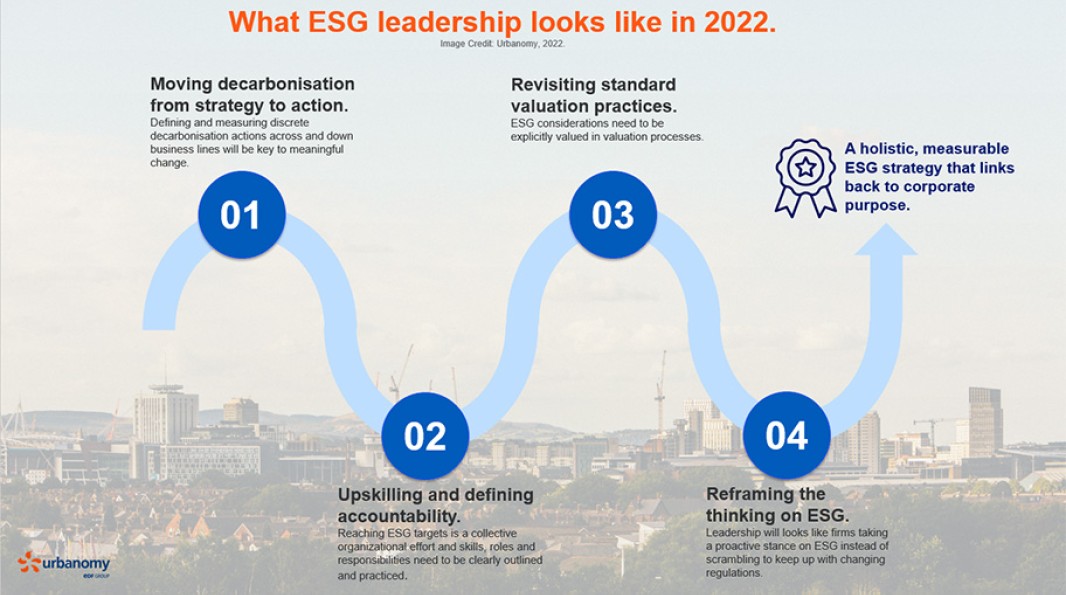

Moving decarbonisation from strategy to action

Many real estate service firms have taken up the challenge of decarbonising existing and new assets by developing internal net zero strategies. There are two key challenges facing firms. The first is that, often, these strategies focus on Scope 1 and 2 emissions, which are typically in the direct control of real estate firms.

However, Scope 3 emissions are a crucial component of the real estate value chain, but they are less straightforward to unpack, account for, and plan to mitigate. Scope 3 emissions are those emissions that occur as a result of the needs of the wider business process. This could be supplier emissions that occur during the procurement of a product or service. In order to comprehensively and collaboratively address the full scope of their emissions, firms must account for Scope 3 emissions as well. Indeed, we’ve seen movement towards this goal, with over 70 firms having set Science-Based Targets, which include Scope 3 emissions, to reduce their emissions to net zero by 2050. Industry leaders will seek to set SBTs or similar to account for the full scope of their emissions.

The second challenge is that high-level strategy may not be adequately reflected in clear action plans. That is, a strategy may take a baseline emissions assessment; identify the contribution of business lines, assets, or operations to cumulative emissions; and then extrapolate reductions over time toward a science-based target. However, the underlying granular actions may not be captured in the required way, or the KPIs may not adequately align with the timeline. Industry leaders will therefore define segmented actions aligned with clear KPIs that align with short-, mid-, and long-term decarbonisation goals.

Upskilling and defining accountability

Even where strategies have been defined in terms of manageable and monitorable action plans, these may not be adequately reflected in day-to-day practice. That is, a fund manager may not understand how her firm’s net zero strategy relates to a decision she needs to make on a value-add and, without proper information and guardrails, may choose an option that is at odds with achieving the firm’s overall targets. Deviations like this will collectively impact the firm’s performance against its objectives (and disclosures) over time.

Therefore, it’s imperative that firms integrate knowledge and skills related to decarbonisation and ESG decision-making across and down business lines. Crucially, firms that seek to make increase their efficiency at ESG will also clearly outline responsibilities and accountabilities for ensuring that targets are met. Think of it this way: in football, the goalie cannot be held solely responsible for letting the opposing team score. Similarly, an organisation’s ESG or Sustainability team cannot be held solely responsible for whether or not that organisation reaches its targets, if all employees and stakeholders are not holding themselves responsible to the actions they each need to take at a granular level. Creating systems that coherently tie remuneration such as bonuses to ESG performance is one method of accountability that’s gaining traction.

Revisiting standard valuation practices

Climate change and ESG considerations require a reimagining of the valuation practices inherent in the real estate industry. So too do the new EU and anticipated UK regulations. In the UK, RICS has explicitly included ESG and Sustainability into its Valuation Global Standards as of January 2022.

Companies that do not properly integrate aspects such as climate risk and their decarbonisation trajectories risk mispricing their assets. Leaders in the industry will seek to identify from where misalignments stem and use this to inform priority action to meet decarbonisation and ESG targets. This includes understanding the transition risk facing assets as we transform to a low-carbon economy. Leaders in this sense will understand that their assets are part of wider systems, and impacts on those systems (e.g. transport, supply chains, energy networks, changing demographics of areas as fossil fuel jobs decline) will impact their assets. They will therefore capture these factors into scenario planning and work to collaborate with other stakeholders where possible to mitigate risks (DNOs, other asset owners/managers, end users).

Setting a robust internal carbon price aligned with net zero is one way to assess project profitability across different scenarios. Great Portland Estates has gone further than many other real estate firms, setting a carbon price of £95 per tonne which feeds into its Decarbonisation Fund, supporting retrofits and acceleration of decarbonisation in London.

Reframing the thinking on ESG

Many firms feel caught out by the changing regulatory landscape in terms of net zero and ESG. Anecdotally, we understand that Sustainability teams spend a good chunk of each year preparing the reporting materials for disclosure, meaning they are responding to current requirements/processes rather than preparing for or, optimistically, shaping future ones. As mentioned, the EU suite of regulations sends a powerful signal to markets that ESG interests are as important as financial interests, a necessary shake to the industry. Therefore, firms that will stand out over the next few years are those that truly embrace long-term thinking, recognizing that decarbonisation is just one component of a broader set of ESG safeguards. Ultimately, it is about reconnecting the ESG narrative to the organisation’s purpose which is, certainly, to create and connect people to value. Under new regulations, a firm cannot be simultaneously creating value in one place while at the same time destroying it in another. Perhaps this will free organisations to think more innovatively about how they can develop their assets in more flexible and resilient ways.

Sources:

https://www.greenbiz.com/article/esg-and-corporate-pay-measure-intent