By Felix Briaud, Urbanomy

25/05/2023

25/05/2023

The CSRD, or Corporate Sustainability Reporting Directive, was adopted in plenary session by the European Parliament in November 2022.

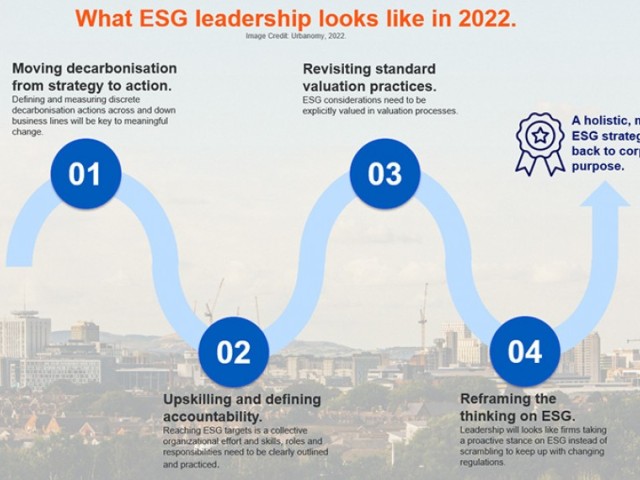

This legislative decision deeply modifies standards regarding the impact of companies on society and the environment. In this field, you may already have come across the three letters "ESG": this acronym, precisely, refers to these environmental, social and governance criteria.

About 50,000 companies should, by the end of the decade, be affected by the CSRD and the mandatory publication of non-financial information. At least in theory. In practical terms, the legislative process is not over and this directive could bear the brunt of a downward revision, by the EU's executive body - the European Commission - of the ambitions of European MEPs.

This article inaugurates a series, from the team at Urbanomy, to help you understand the European regulation environment.

A major topic, yet information is scarce

To be honest: as this article is being written, the mainstream media has more or less ignored the subject of the CSRD (Corporate Sustainability Reporting Directive), the new European directive on corporate sustainability reporting. We won't hold it against them: the final text was published in the Official Journal of the European Union in the final days of 2022, at a time when concerns were not exactly oriented towards European legislation...

It would nevertheless be ill-advised not to take up the question because the CSRD is neither more nor less than a change of paradigm, according to the French MEP Pascal Durand, rapporteur of the text in the European Parliament: "it's a new conception of the role of companies in society," he told the French daily Ouest-France last November, that shakes up "the logic which made a firm solely a private space of private interests."

Extra-financial performance at the same level as financial performance

To state things clearly: the impact of a business' activity on climate change, its use of natural resources, the pollution it emits, its carbon footprint but also its commitments to respect human rights and labour laws will become concerns of public interest, available free of charge (at least in part) on a dedicated platform to be set up at a European level.

Why now? First, the weaknesses of the previous directive which governed this area became apparent over time; but the Union is above all well aware it has to see firms as allies if it hopes to achieve the objectives it has set itself through the European Green Deal voted in 2020 - first and foremost the promise to make the continent a net zero emitter of greenhouse gases by 2050.

The E.U. has therefore decided, with the CSRD, to pick up the pace on green transition and the establishment of standards relating to human and social rights which would be standards "made" in Europe and not norms that the United States, for example, would seek to make universal.

The ambition of this European directive could be summarized as follows: a company's results in terms of sustainable development will become just as important as its financial indicators. Its responsibility will be scrutinized with equal attention, by the public and investors alike.

Why now? First, the weaknesses of the previous directive which governed this area became apparent over time; but the Union is above all well aware it has to see firms as allies if it hopes to achieve the objectives it has set itself through the European Green Deal voted in 2020 - first and foremost the promise to make the continent a net zero emitter of greenhouse gases by 2050.

The E.U. has therefore decided, with the CSRD, to pick up the pace on green transition and the establishment of standards relating to human and social rights which would be standards "made" in Europe and not norms that the United States, for example, would seek to make universal.

The ambition of this European directive could be summarized as follows: a company's results in terms of sustainable development will become just as important as its financial indicators. Its responsibility will be scrutinized with equal attention, by the public and investors alike.

The reporting obligation will apply to nearly five times more firms

If only one change introduced by the CSRD were to be retained, it would undoubtedly be that of moving publication of information related to firms' social and environmental responsibility from virtually voluntary to mandatory.

Previously, companies were free to make this declaration of their impact on people and the planet (with some slight exceptions). With the CSRD, they will gradually no longer have the choice to do so.

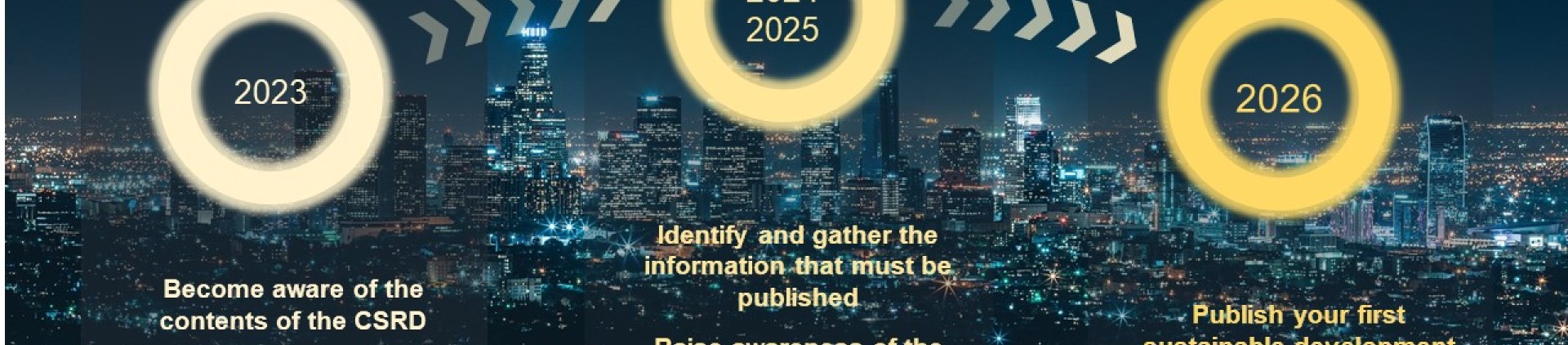

While companies with more than 500 employees, already subject to this requirement, will have to publish their sustainable development reports according to the new CSRD standards from the beginning of 2025 (covering the 2024 financial year), the binding nature of the publication by the newly affected companies will take place as follows:

Previously, companies were free to make this declaration of their impact on people and the planet (with some slight exceptions). With the CSRD, they will gradually no longer have the choice to do so.

While companies with more than 500 employees, already subject to this requirement, will have to publish their sustainable development reports according to the new CSRD standards from the beginning of 2025 (covering the 2024 financial year), the binding nature of the publication by the newly affected companies will take place as follows:

- Beginning of 2026 (covering the 2025 financial year) for companies with a workforce of between 250 and 500 people and achieving either a net turnover of at least 40 million euros, or a balance sheet of at least 20 million euros

- Beginning of 2027 (covering the 2026 financial year) for listed SMEs with a workforce of between 10 and 250 people and achieving either a net turnover of between €700,000 and €40 million, or a balance sheet of between €350,000 and 20 million euros. Important clarification: these companies may, with justification, request an additional period of two years to comply with this obligation. Those requesting this derogation would then publish their first report in early 2029 (covering the 2028 financial year)

- Beginning of 2029 (relating to the 2028 financial year) for non-European entities having generated on the territory of the European Union and during the two preceding consecutive financial years a net turnover of at least 150 million euros (d other conditions apply which we are happy to spare here).

These expanded qualification criteria increase the number of companies subject to the publication of this information from approximately 11,000 to nearly 50,000. Even unlisted SMBs/SMEs will be invited, with the CSRD, to publish information relating to their sustainability approach, in a simplified way and taking into account their more limited capacities.

High requirements but transposition by member states into their national laws should be followed closely

Among the upheavals caused by this new directive, the one that was the subject of the most intense negotiations was certainly the question of the control and certification of sustainable development reports by financial auditors, in the same way as financial reports, with standards common to the entire European Union.

An independent expertise will therefore be sought in order to guarantee the sincerity of reports and procedures, proof of the strong desire of the 27 member states to bring information relating to the a firm's sustainability to the same degree of seriousness as its financial information.

These firms will verify in particular the principle of "double materiality", a central aspect of the CSRD: it is the idea of looking not only at the consequences on a firm's activity of the social and environmental aspects deteriorating; but also the impact of a firm's activity on these same social and environmental aspects - a sort of dual dialogue and reciprocity principle.

You have understood: in this quest for exemplarity pursued by the Corporate Sustainability Reporting Directive, the requirement level is quite high and Urbanomy can guide your company through its climate strategy offer. As with its predecessor, the NFRD directive, the transposition of the CSRD by all 27 member states at their respective national levels, which must take place before July 2024, will have to be closely scrutinized.

In the middle of the last decade, France had for example chosen to exclude SASs, simplified joint-stock companies, from the scope of the Déclaration de Performance Extra-Financière (DPEF), transposition into French law of the previous NFRD directive.

On the European Commission's side, recent information - still unofficial - indicates that the executive body of the Union would consider revisiting, by the end of June 2023, the mandatory nature of reporting. In Brussels, the lobbying has intensified in recent months on the part of bodies defending business interests.

An independent expertise will therefore be sought in order to guarantee the sincerity of reports and procedures, proof of the strong desire of the 27 member states to bring information relating to the a firm's sustainability to the same degree of seriousness as its financial information.

These firms will verify in particular the principle of "double materiality", a central aspect of the CSRD: it is the idea of looking not only at the consequences on a firm's activity of the social and environmental aspects deteriorating; but also the impact of a firm's activity on these same social and environmental aspects - a sort of dual dialogue and reciprocity principle.

You have understood: in this quest for exemplarity pursued by the Corporate Sustainability Reporting Directive, the requirement level is quite high and Urbanomy can guide your company through its climate strategy offer. As with its predecessor, the NFRD directive, the transposition of the CSRD by all 27 member states at their respective national levels, which must take place before July 2024, will have to be closely scrutinized.

In the middle of the last decade, France had for example chosen to exclude SASs, simplified joint-stock companies, from the scope of the Déclaration de Performance Extra-Financière (DPEF), transposition into French law of the previous NFRD directive.

On the European Commission's side, recent information - still unofficial - indicates that the executive body of the Union would consider revisiting, by the end of June 2023, the mandatory nature of reporting. In Brussels, the lobbying has intensified in recent months on the part of bodies defending business interests.

Sources:

- AEF Info: https://www.aefinfo.fr/depeche/686390-la-transposition-de-la-directive-csrd-franchit-une-nouvelle-etape

- Les Echos: https://www.lesechos.fr/finance-marches/marches-financiers/lunion-europeenne-trouve-un-accord-sur-le-reporting-extra-financier-1414976

- Mazars: https://www.mazars.fr/Accueil/Services/Transformation-durable/Transition-vers-la-directive-CSRD

- Novethic: https://lessentiel.novethic.fr/blog/l-actu-1/post/csrd-le-lobbying-intense-contre-le-reporting-esg-pourrait-avoir-raison-de-lambition-europeenne-1196

- Ouest-France: https://www.ouest-france.fr/europe/ue/en-2024-les-grandes-entreprises-devront-dire-publiquement-quel-est-leur-impact-sur-l-environnement-3a6eeeb8-5f7f-11ed-a35d-20354ea697f9

About the author

Felix Briaud

Felix is Urbanomy's communication & ESG manager.

A journalist for ten years, he drifted towards data applied to digital advertising. Only recently did he convince himself, by joining the practice, to align his professional life with his personal beliefs about the environment.

Aside from that, Felix is mad about music - particularly that from the 1950s to the 1970s. In this area as in others, he is a bottomless source of fun facts and would happily share a couple with you.

A journalist for ten years, he drifted towards data applied to digital advertising. Only recently did he convince himself, by joining the practice, to align his professional life with his personal beliefs about the environment.

Aside from that, Felix is mad about music - particularly that from the 1950s to the 1970s. In this area as in others, he is a bottomless source of fun facts and would happily share a couple with you.